Deep Battery Heritage,

Diversified Capital Growth

Ike Investment는 약 1억 2천만 달러의 자기자본을 운용하는 단일 패밀리 오피스입니다.

회사의 뿌리는 30년 이상 배터리 산업에 있습니다.

Kokam을 30년, RouteJade를 15년간 직접 운영하며 산업 전반에 깊이 뿌리내렸고,

두 회사를 성공적으로 매각한 경험이 현재 패밀리오피스를 설립하는 기반이 되었습니다.

또한 셀 부품, 배터리 전자, 제조 장비 회사 등 여러 배터리 관련 기업을 함께 운영하며

산업 전반에서 실무적 경험을 쌓아왔습니다.

현재 우리는 주식, 채권, 실물자산, 대체투자 등 다양한 자산에 분산 투자하며 가족 자본의

장기적인 성장을 추구하고 있습니다. 배터리 분야에서의 경험은 여전히 중요한 투자 테마로

남아 있으며, 필요할 때는 선택적으로 직접 투자를 이어가고 있습니다.

-

Our Investment Approach

as a Single Family Office -

Ike Investment is a single family office with focused governance led by the founding

generation, enabling fast and disciplined decisions. We invest only our own capital,

partnering with leading managers across public and alternative markets,

complemented by occasional selective direct and co investments.Our platform emphasizes strategic asset allocation and broad diversification across

equities, fixed income, real assets, and alternatives. We are progressively reducing

fixed income exposure and reallocating toward trading and hedge fund strategies.

Every decision is anchored by deep diligence, disciplined portfolio construction,

and strong risk and liquidity management.

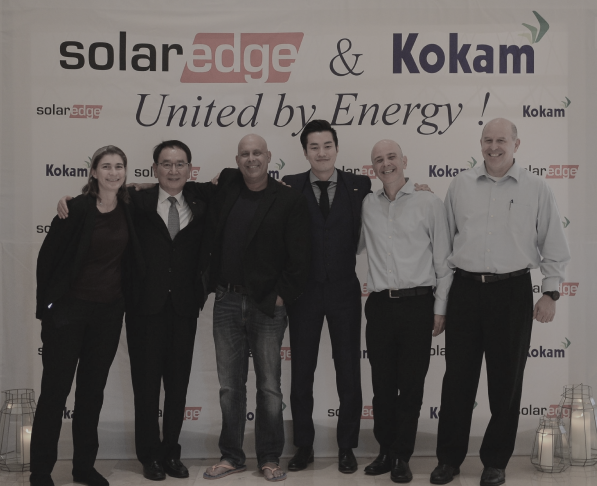

Operator Heritage in Advanced Batteries

Kokam – SolarEdge, Signing Ceremony

Kokam – SolarEdge, Signing CeremonyKokam

Kokam was our family owned company for more than 30 years, pioneering lithium ion cell

manufacturing in Korea. In 2018, Ike personally led its landmark cross border sale to SolarEdge, marking

the first successfully completed transaction of its kind in the Korean secondary battery sector.

Following the sale, Ike served as President of Kokam for four years to oversee post merger integration

and operations.

RouteJade - Enovix, M&A Ceremony

RouteJade - Enovix, M&A CeremonyRouteJade

RouteJade was another family business that our family built and operated for more than 15 years.

The company was first sold to ACE Equity Partners in 2021 under the leadership of our founding generation.

In 2023, Ike directed its successful exit from ACE to Enovix, serving as lead advisor throughout the

entire process and completing the second landmark cross border M&A in Korea’s battery industry.

Thematic Edge

We pursue selective exposure to themes where we hold strong conviction,

combining our deep battery heritage with a diversified allocation

across public and alternative strategies.

Our family capital is deployed across technology and industrial value chains where we possess unique insight.

Secondary battery remains one of our core strengths, managed alongside a broad spectrum of opportunities within our multi asset platform.

Investment Request

Accelerating Founder’s Business

Achieve both investor returns and investment company growth based on the

expertise of the battery industry.